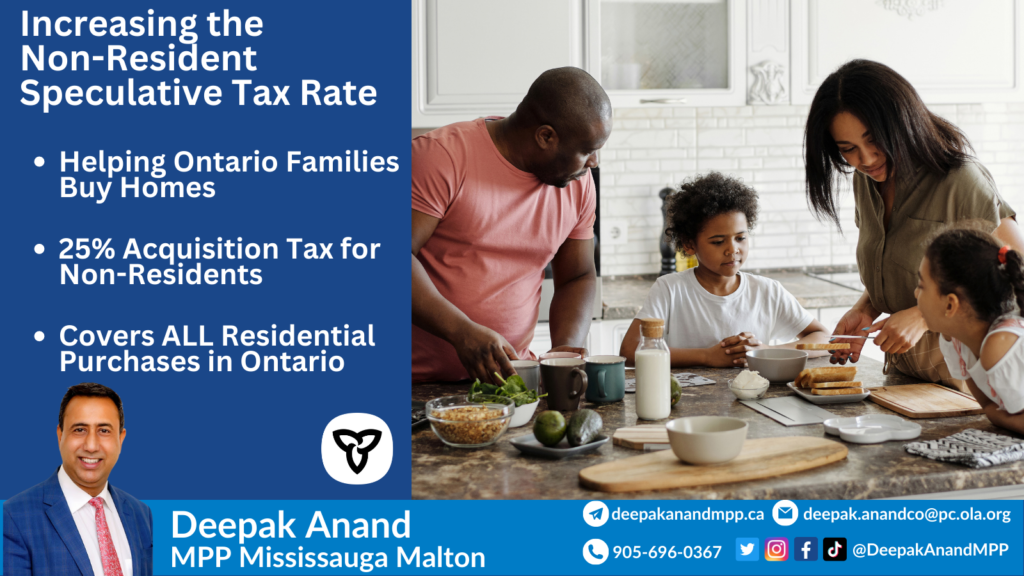

Increasing the Non-Resident Speculative Tax Rate

Helping Ontario Families Buy Homes

Ontario is helping families buy homes by reducing the number of vacant properties through the Non-Resident Speculative Tax (NRST) which has been increased to 25%.

The NRST applies to the purchase or acquisition of any residential properties in Ontario by by Foreign Nationals (those who are not Canadian Citizens or Permanent Residents), Foreign Corporations or Taxable Trustees.

Some Exemptions May Apply:

An exemption from NRST may be available for registered transfers if the transferee is a nominee, a protected person or a spouse of a Canadian citizen, a permanent resident of Canada, a nominee or a protected person, as outlined below. Supporting documentation may be required by the ministry to substantiate all claims for an NRST exemption. Exemptions will not apply if a taxable trustee is a transferee in the conveyance of land subject to the exemption.